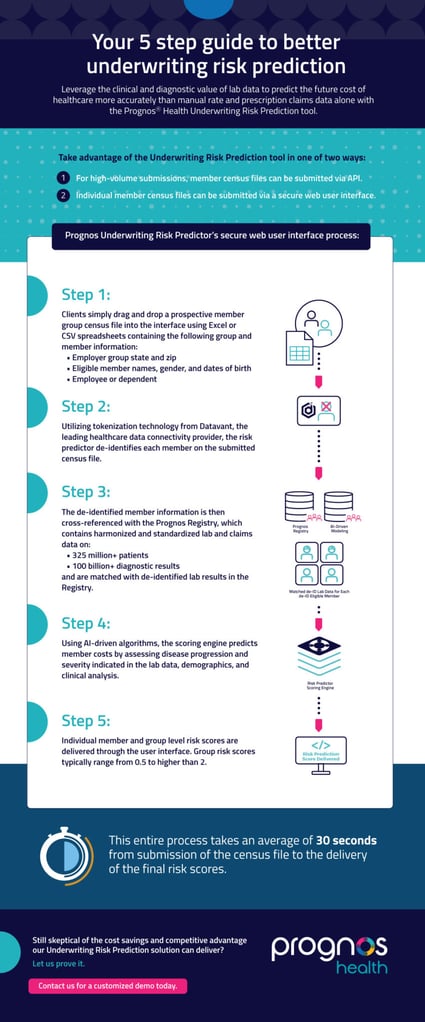

Your 5 step guide to better underwriting risk prediction accuracy

Leverage the clinical and diagnostic value of lab data to predict the future cost of healthcare more accurately than manual rate and prescription claims data alone with the PrognosⓇ Underwriting Risk Prediction tool. Take advantage of the tool in one of two ways:

- For high-volume submissions, member census files can be submitted via API

- Individual member census files can be submitted via a secure web user interface.

Prognos Underwriting Risk Predictor’s secure web user interface process:

Let us prove it.

Step 1: Clients simply drag and drop a prospective member group census file into the interface using Excel or CSV spreadsheets containing the following group and member information:

- Employer group state and zip

- Eligible member names, gender, and dates of birth

- Employee or dependent

Step 2: Utilizing tokenization technology from Datavant, the leading healthcare data connectivity provider, the risk predictor de-identifies each member on the submitted census file.

Step 3: The de-identified member information is then cross-referenced with the Prognos Registry, which contains harmonized and standardized lab and claims data on:

- 325 million+ patients

- 100 billion+ diagnostic results

and are matched with de-identified lab results in the Registry.

Step 4: Using AI-driven algorithms, the scoring engine predicts member costs by assessing disease progression and severity indicated in the lab data, demographics, and clinical analysis.

Step 5: Individual member and group level risk scores are delivered through the user interface. Group risk scores typically range from 0.5 to higher than 2.

This entire process takes an average of 30 seconds from submission of the census file to the delivery of the final risk scores.

Still skeptical of the value a Underwriting Risk Prediction solution brings to cost savings and competitive advantage? Let us prove it. Contact us for a customized demo today.